WhatsApp has been a staple business communication platform for a while now and it has been widely used for this purpose owing to its exceptional communication capabilities. But WhatsApp has become more than that now.

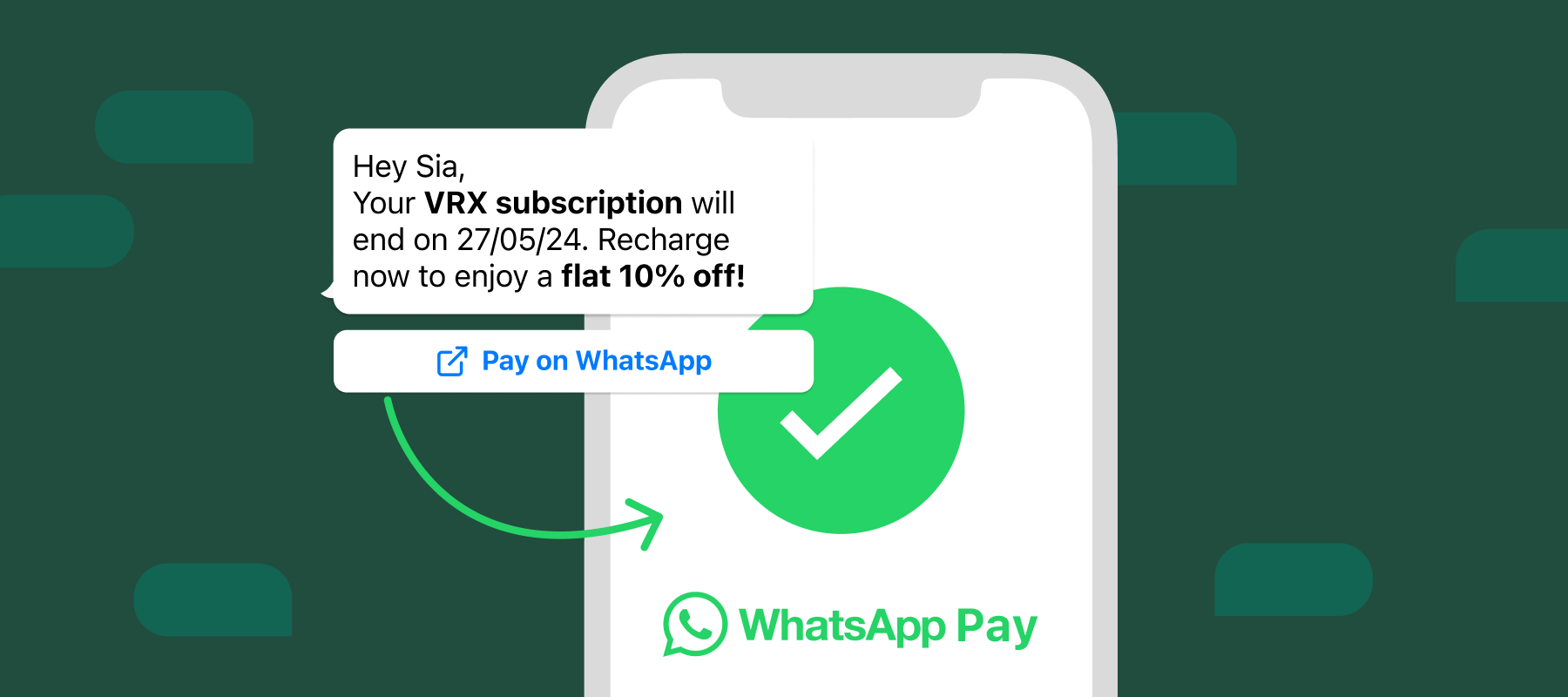

Besides being a great marketing platform, it is also a commerce channel that can enable end-to-end transactions as well. Setup WhatsApp Pay for businesses sell and accept payments on the app itself without redirecting the customers to other payment gateways.

In this guide, we will talk on everything you need to know about WhatsApp Pay for business.

Is WhatsApp Pay enabled in my region?

Before you go ahead and learn how to setup WhatsApp Pay for your business, you need to know if you can use WhatsApp Pay in your region.

You will be able to setup WhatsApp Pay for your business in selected countries including Singapore, Brazil and India. Hence, if your business operates outside of these countries, WhatsApp Pay will not be available for you. The countries where WhatsApp Pay is available include India, Brazil and Singapore.

In Brazil, the country with the second largest WhatsApp user base, WhatsApp Pay is hosted by partnerships with local financial institutions. Whereas in India, WhatsApp Pay is enabled by partnering with the Indian government’s UPI system.

Brazil and India have been at the forefront of the initial launch of WhatsApp Pay, allowing businesses and individuals in these regions to carry out transactions on the platform directly. WhatsApp Pay in Singapore however, at this moment limits individuals to making payments to just registered businesses. As of now peer-to-peer WhatsApp Pay transactions aren’t available in Singapore. WhatsApp is aiming to expand the payment feature and make it accessible in other countries as well.

How to setup WhatsApp Pay for WhatsApp Business Account in India?

WhatsApp Pay was first released in 2018 in beta mode in India. Initially, only 1 million users had access to the test. But after a successful reception, it has become a major payment method that is available in 10 different major regional languages across the country.

WhatsApp Pay in India works with the government’s BHIM UPI platform that is processed by payment partners such as HDFC, SBI, Axis Bank etc. This makes sending and receiving payments through WhatsApp extremely easy in India.

Steps to setup WhatsApp Pay for users using WhatsApp Business App through UPI:

Step 1: Open the chat of who you wish to make a transaction with. Then open the “attachments” button which will look like a paperclip.

Step 2: Open “Payment” and enter the payment amount.

Step 3: Follow the instructions and give the UPI pin for verification.

Step 4: After the transaction is done, you will receive a message confirming the transfer.

As of 2023, there are more than 260 million UPI users, which makes utilizing UPI-enabled WhatsApp Pay extremely beneficial for businesses that are using WhatsApp for business communication.

The Indian consumer who values time and ease will find it comfortable to browse, place orders and even complete transactions on a single platform.

Steps to setup WhatsApp Pay for businesses with Interakt’s WhatsApp Business API:

Step 1: Open WhatsApp, select the menu from the top right corner and navigate to select “Payments”.

Step 2: From here select “Add new payment method”.

Step 3: From the provided list choose your bank.

Step 4: After this, verify your phone number.

Step 5: Once the verification is done, set up your UPI pin if you don’t have one already. If you have a UPI pin you just have to enter it to complete set-up.

If you are operating from India, it is only practical to fully leverage this WhatsApp feature. With additional tools to streamline processes and offer superior customer service, you can create self-contained and capable business interactions through WhatsApp.

With solutions like Interakt, all the major business communication processes including product browsing, order processing, payment handling, transaction confirmations and customer support can be handled with ease on WhatsApp itself.

Collect payments from your customers on WhatsApp

With Interakt’s native WhatsApp Pay feature, you can now address the complete customer lifecycle on WhatsApp – Acquisition to Conversion!

Your customer won’t be redirected to any 3rd party payment page for making the payment. Instead, they can make the payment natively within WhatsApp via any of the below options:

– Any UPI app installed on their phones

– Debit / Credit cards

– Netbanking

– UPI connected to their WhatsApp

How to setup WhatsApp Pay for WhatsApp Business Account in Brazil

WhatsApp Pay in Brazil was enabled by working with local banks including Nubank, Sicredi, Cielo and Banco do Brasil. It was officially green-lighted in March 2023, enabling small businesses to both communicate and sell products directly through the app. Brands can now quickly and securely collect payments without any extra fees or having to direct customers to alternative payment methods.

Steps to setup WhatsApp Pay for users in Brazil using WhatsApp Business App

Step 1: Open WhatsApp and select the menu.

Step 2: Go to settings and navigate to payments. Select Facebook Pay from here and click on “Add New Card”.

Step 3: Enter your card details such as debit/credit card number etc. After this read and accept the terms and conditions.

Step 4: Now you will have to verify your card with the verification code that will be sent to the number connected to your bank account via SMS. Enter the code once you get it.

Step 5: After verification create your six-digit Facebook Pay pin, which you will be using for future transactions.

Conclusion

If you’re a business that has been experiencing high drop-offs in the buyer journey, WhatsApp Pay can help you optimize for purchase completion. By bringing the transaction interface into the chat, it reduces the back and forth for customers as well, leading to higher conversions.

Ready to set up WhatsApp Pay to create end-to-end customer journeys?